Interest plays a significant role in the financial world. Whether it’s a loan, investment, or delayed payment, interest is either earned or charged as compensation for money.

Interest can be calculated on the basis of Simple or Compound Interest , In TallyPrime, you can calculate Simple Interest easily, which is one of the simplest methods for interest calculation.

Simple Interest (SI) is calculated using the formula:

SI = (Principal × Rate × Time) / 100

- Principal: The loan or amount on which interest is calculated.

- Rate: The percentage rate of interest per year.

- Time: The duration for which interest is calculated (in years or months).

For example, if ₹10,000 is borrowed at an interest rate of 10% per year for 1 year, the interest would be:

SI = (10,000 × 10 × 1) / 100 = ₹1,000

Benefits of Using Interest Calculation in TallyPrime

- Automated Calculation: No manual effort; TallyPrime calculates interest accurately.

- Multiple Methods: Choose between Simple Interest or Compound Interest.

- Transparency: Track interest charged or earned for each party or loan.

- Reports: Generate detailed statements for auditing and decision-making.

- Customization: Set different rates for different parties or transactions.

Step 1 Enable Interest Calculation Features In Tally Prime by Pressing F11 Key.

Step 2 Create / Alter A Ledger and Enable Activate interest calculation.

Step 3 Interest Parameter Setting

In this Tutorial Suppose Interest Will Apply 10% Yearly After Payment Due Date When Any Party Crossed His Payment Date, Then We will Charge @ 10% Yearly as Interest or (According to your Companies / Farm Rules).

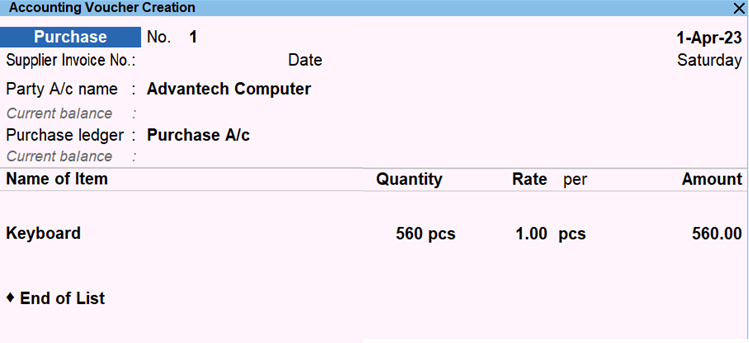

Step 4 Company Purchase Following Item on Credit 30 days

- Purchase Date 01-04-23

- Credit Days 30

- Due Date 01-05-23

Step 5 Due Date or Credit Days Setup (30 Days) – according to your requirement

Balance sheet

Company didn’t pay their amount till 02-11-23 due any reason , so here interest will be applied from 02-05-23 to 02-11-23.

See Interest Report

GOT >> Display More Report >> Statement of Account >> >> Interest Calculation >> Interest Payable >> F2 > Choose Period

Interest Report

Step 6 Pass Credit Note Voucher (ALT + F6) Against Interest Amount to Party Account

- Credit Note Voucher Date – 02-11-23

- Voucher Mode –

- Ledger Name Interest Paid Under Indirect Expense

Ledger Creation (Interest Paid)

Note : Open Credit Note Voucher and Press CTRL + H to change Voucher Mode –

Set up Reference

Credit Note will be like some thing this

Balance Sheet After Credit Note You will be showed interest amount added into part account and your Liabilities will be Increased.

Step 7 Payment Voucher Against bill No

Payment Voucher

TallyPrime simplifies the process of Simple Interest Calculation, saving time and reducing errors. Whether you’re tracking loans, delayed payments, or investments, the feature helps you manage your finances effectively. Follow the step-by-step guide above to start calculating interest in TallyPrime effortlessly.